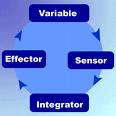

The Negative Feedback Loop

excerpts from this week’s report:

“In a week packed with reports, speeches, and events about the only thing that is nearly 100% to occur is the beginning of the end of Rudy Giuliani’s quest to become President of the United States. As America’s Mayor competes with Fred Thompson for the most boneheaded political strategy award, investors will focus on the plethora of data to be issued over the next five days.

For example, this week includes:

• Earnings reports (120 of the S&P 500)

• Economic reports (Dec. Durable Goods, 4Q advance GDP, Dec. Personal income and spending, Consumer sentiment, Jan. ISM Mfg., and Jan. Employment data)

• Speeches (Bush State of the Union)

• Events (FOMC rate decision, US Senate on stimulus package, IMF economic forecast, Florida primary)

The crosscurrents that will result from the above…”

Investment Strategy Implications

“With valuation levels forecasting a deep recession (see Expected Return Valuation Model on page 4 of report)*, any development that changes this newly entrenched thinking stands a reasonable chance of breaking the negative feedback loop. The great risk, of course, is should the vicious downward spiral…”

also in this week's report:

* Expected Return Valuation Model

* Moving Averages Scorecard

* Model Growth Portfolio

* Sectors and Styles Market Monitor

* Key US Economic Indicators

*To gain access to this week's report (and all reports), click on the subscription information link to your left.

No comments:

Post a Comment